UT TC-131 2012-2026 free printable template

Show details

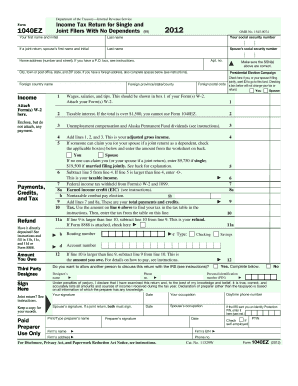

13112 Utah State Tax Commission TC-131 Statement of Person Claiming Refund Due a Deceased Taxpayer Rev. 9/12 See instructions on the reverse aside. 4. At least thirty days have elapsed since the death of the decedent. 5. No application or petition for the appointment of a personal representative is pending or has been granted in any jurisdiction. 6. As the claiming successor of the decedent I am entitled to payment or delivery of the state tax re...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign tc 131 form

Edit your pdffiller form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tc131 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tc form online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form tc. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tc737 form

How to fill out UT TC-131

01

Gather necessary documents including identification and tax information.

02

Obtain the UT TC-131 form from the official Tax Commission website or local office.

03

Start by filling in your name, address, and Social Security number at the top of the form.

04

Provide the relevant tax period for which you are filing the form.

05

Complete the sections related to any adjustments, credits, or other tax-related information as required.

06

Double-check all entered information for accuracy and completeness.

07

Sign and date the form at the designated area.

08

Submit the completed form via the designated method (mail or online) as instructed.

Who needs UT TC-131?

01

Individuals or businesses seeking to amend a tax return.

02

Taxpayers who need to report changes to income or deductions.

03

Anyone claiming tax credits or adjustments.

04

Individuals following up on additional tax liabilities or refunds.

Fill

form

: Try Risk Free

People Also Ask about

Who gets the tax refund of a deceased person?

If you file a return and claim a refund for a deceased taxpayer, you must be: A surviving spouse/RDP. A surviving relative. The sole beneficiary.

Is there a Utah withholding form?

Report Utah withholding tax from the following forms: Federal form W-2, Wage and Tax Statement. Federal form 1099 (with Utah withholding), including 1099-R, 1099-MISC, 1099-G, etc.

Is there a Utah w4 form?

Complete Form W-4 so your employer can withhold the correct federal income tax from your pay. Consider completing a new Form W-4 each year and when your personal or financial situation changes. This change may also be done electronically in the Employee Self Serve System.

Do you have to file taxes for your deceased parent?

In general, file and prepare the final individual income tax return of a deceased person the same way you would if the person were alive. Report all income up to the date of death and claim all eligible credits and deductions.

Does Utah have a state withholding form for employees?

Utah provides a short-term service nonresident employee exemption from withholding. See Withholding on Residents, Nonresidents and Expatriates. Utah employers determine withholding using federal Form W-4. See Form W-4.

Do you need to send federal return with state return?

Filing taxes for most taxpayers in most states means filing a federal and a state return. Usually, federal and any state returns should be filed at the same time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find UT TC-131?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific UT TC-131 and other forms. Find the template you need and change it using powerful tools.

How do I complete UT TC-131 online?

pdfFiller has made it easy to fill out and sign UT TC-131. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I fill out the UT TC-131 form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign UT TC-131. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is UT TC-131?

UT TC-131 is a tax form used in Utah for reporting income and expenses related to certain tax credits.

Who is required to file UT TC-131?

Individuals and businesses claiming specific tax credits in Utah are required to file UT TC-131.

How to fill out UT TC-131?

To fill out UT TC-131, enter personal identification information, applicable income details, and report the expenses or credits as instructed on the form.

What is the purpose of UT TC-131?

The purpose of UT TC-131 is to provide the Utah state government with information necessary to calculate and administer tax credits that benefit eligible taxpayers.

What information must be reported on UT TC-131?

UT TC-131 requires the reporting of personal identification information, details of income, associated expenses, and any tax credits being claimed.

Fill out your UT TC-131 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UT TC-131 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.